The Best Strategy To Use For Palau Chamber Of Commerce

Table of ContentsRumored Buzz on Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For EveryoneThe Main Principles Of Palau Chamber Of Commerce Palau Chamber Of Commerce - The FactsAn Unbiased View of Palau Chamber Of CommerceThings about Palau Chamber Of CommerceThe 5-Second Trick For Palau Chamber Of CommerceNot known Details About Palau Chamber Of Commerce The Ultimate Guide To Palau Chamber Of Commerce

In an attempt to offer info to individuals preferring to begin a non-profit organization in Maryland, the Charitable Organizations Division of the Office of the Secretary of State has actually collected details state listed below on the essential actions to create a charitable company. While every effort has actually been made to ensure the accuracy of the information, please be advised that specific questions and information should be directed to the appropriate firm.

Fascination About Palau Chamber Of Commerce

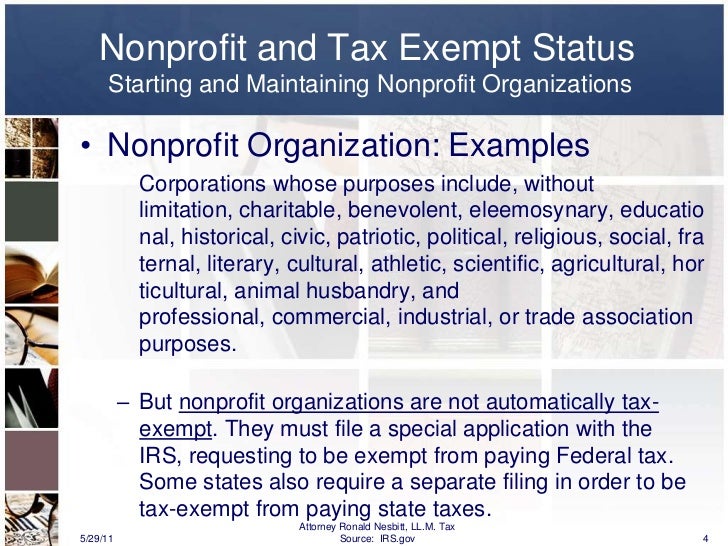

Before the Irs can provide your company tax-exempt status, your organization needs to be developed as either an organization, firm, or trust fund. A duplicate of the arranging file (i. e., posts of consolidation authorized and also dated by proper state official, constitution or articles of organization, or authorized and dated trust fund instrument) should be filed with the IRS's Application for Acknowledgment of Exception.

To help non-profit organizations, the firm has actually prepared a guideline for articles of incorporation for charitable organizations which can be obtained by contacting the agency. The firm's address is 301 West Preston Street, Baltimore MD 21201, and its phone number is 410-767-1340. Types and information can be gotten from the company's internet site.

The Buzz on Palau Chamber Of Commerce

State law, nonetheless, gives the State Department of Assessments and also Taxation the authority to perform regular reviews of the granted exemptions to make sure continued conformity with the demands. While the tax-exempt standing provided by the internal revenue service is required to process the exception application, the standing given by the internal revenue service does not instantly guarantee that the organization's home will certainly be exempt.

To receive an exception application kind or information regarding the exception, please speak to the State Department of Assessments and Tax workplace for the area in which the home is situated. You might find a list of SDAT regional offices, added details, as well as duplicates of the required forms on SDAT's website.

The Of Palau Chamber Of Commerce

Because method, they likewise benefit their communities. Certain sorts of businesses that are also identified as social ventures have the alternative of registering their services either as a routine company or as a nonprofit corporation. The company's objective may be the very best indicator of just how ideal to register the company.

It's common for individuals to refer to a nonprofit organization as a 501(c)( 3 ); nevertheless, 501(c)( 3) refers to a area of the internal revenue service code that describes the needs required for organizations to certify as tax-exempt. Organizations that qualify for 501(c)( 3) status are required to run exclusively for the objective they specify to Get More Info the IRS.

Examine This Report about Palau Chamber Of Commerce

Any type of cash that nonprofits get have to be recycled back into the company to fund its programs as well as procedures. Donors that make contributions to firms that fall under the 501(c)( 3) code may subtract their payments at the annual tax declaring day. One of the most significant distinctions between for-profit as well as not-for-profit entities is how they obtain funding to run their businesses.

There Are 3 Main Types of Charitable Organizations The IRS designates 8 groups of companies that may be allowed to run as 501(c)( 3) entities., consisting of public charities, exclusive structures as well as private operating foundations.

Palau Chamber Of Commerce Can Be Fun For Anyone

Contributors for private structures may give away as much as 30% of their income without paying tax obligations on it. Personal Operating Foundations The least usual of the three primary sorts of 501(c)( 3) corporations is the exclusive operating foundation. They resemble personal structures, however they additionally use energetic programs, just like a public charity.

They are managed somewhat like exclusive foundations. Both private foundations and also private operating structures click aren't as heavily inspected as other charitable foundations since donors have close connections to the charity. There are 5 other kinds of 501(c)( 3) organizations that have certain objectives for their organizations, consisting of: Scientific Literary Testing for public security To cultivate national or worldwide amateur sporting activities competitions Prevention of viciousness to children or pets Companies in these groups are greatly regulated as well as kept track of by the internal revenue service for compliance, particularly with regard to the contributions they use for political advocacy.

Our Palau Chamber Of Commerce Statements

Nonprofit companies are banned from giving away straight to any type of political candidate's campaign fund. In addition, not-for-profit companies can not campaign actively for any political candidates.

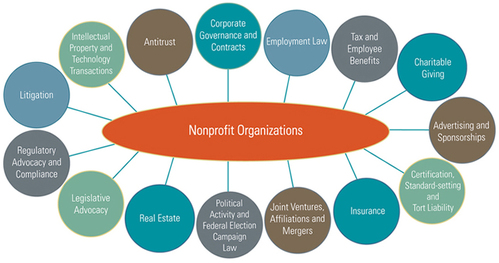

Board Directors and also Participants of Nonprofits Must Comply With All Regulation Board directors and others connected with not-for-profit organizations should recognize all regulations that they run into when working in or with a nonprofit company. As an example, donors can mark exactly how they desire nonprofits to use their funds, which are called limited funds.

Palau Chamber Of Commerce Fundamentals Explained

This section has analytical tables, write-ups, and also other information on charities and various other tax-exempt companies. Nonprofit philanthropic companies are exempt under Section 501(c)( 3) of the Internal Earnings Code.

Palau Chamber Of Commerce Can Be Fun For Anyone