Unknown Facts About Palau Chamber Of Commerce

Table of ContentsThings about Palau Chamber Of CommerceThings about Palau Chamber Of CommerceThe Definitive Guide to Palau Chamber Of CommerceNot known Factual Statements About Palau Chamber Of Commerce Palau Chamber Of Commerce Things To Know Before You Buy8 Simple Techniques For Palau Chamber Of CommerceAll About Palau Chamber Of CommerceWhat Does Palau Chamber Of Commerce Mean?

As an outcome, nonprofit crowdfunding is ordering the eyeballs these days. It can be utilized for specific programs within the organization or a general contribution to the reason.Throughout this action, you could desire to believe concerning turning points that will certainly show an opportunity to scale your not-for-profit. When you've run for a bit, it's essential to take some time to think concerning concrete growth goals.

Top Guidelines Of Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in different states in the US: Starting a Nonprofit Frequently Asked Questions 1. Exactly how a lot does it cost to begin a not-for-profit organization?

The Main Principles Of Palau Chamber Of Commerce

With the 1023-EZ form, the processing time is typically 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a not-for-profit limited obligation business, nevertheless, it ought to be entirely had by a single tax-exempt not-for-profit company.

What is the distinction between a foundation and also a nonprofit? Structures are normally funded by a family members or a company entity, however nonprofits are funded through their incomes and fundraising. Foundations usually take the cash they started with, invest it, and afterwards distribute the cash made from those investments.

An Unbiased View of Palau Chamber Of Commerce

Whereas, the added cash a not-for-profit makes are used as running prices to fund the organization's goal. Is it hard to begin a not-for-profit organization?

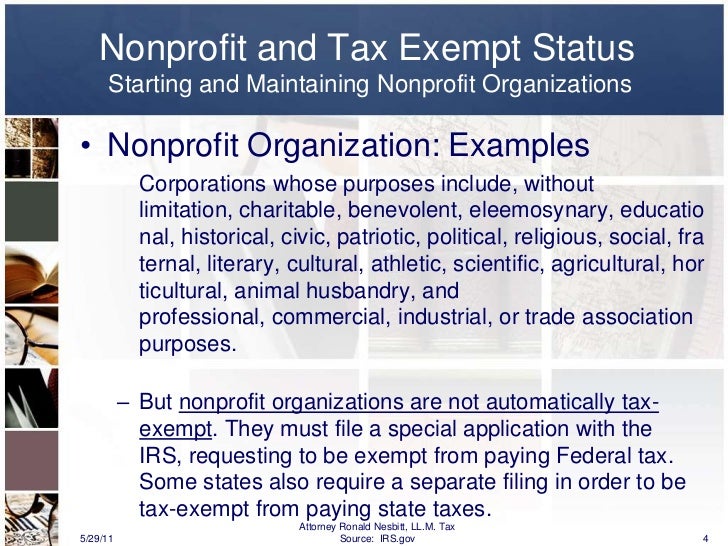

There are a number of actions to begin a nonprofit, the barriers to entry are fairly few. Do nonprofits pay taxes? If your nonprofit gains any type of revenue from unassociated activities, it will owe earnings taxes on that amount.

Palau Chamber Of Commerce Fundamentals Explained

Twenty-eight different sorts of not-for-profit companies are identified by the tax law. By much the most typical kind of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax code that licenses such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, instructional, or scientific. Area 501(c)( 3) organization have one massive advantage over all various other nonprofits: contributions made to them are tax insurance deductible by the contributor.

Excitement About Palau Chamber Of Commerce

The bottom line is that private foundations obtain a lot worse tax treatment than public charities. The major distinction between personal foundations and public charities is where they obtain their monetary assistance. An exclusive foundation is generally regulated by a private, family members, or company, and also obtains the majority of its income from a couple of benefactors and also financial investments-- a fine example is the Expense and Melinda Gates Foundation.

The Palau Chamber Of Commerce Diaries

Many foundations get redirected here simply give money to various other nonprofits. As a sensible issue, you need at the very least $1 million to begin a personal structure; otherwise, it's navigate here not worth the problem and expense.

Other nonprofits are not so fortunate. The IRS initially presumes that they are personal structures. Nonetheless, a new 501(c)( 3) company will be identified as a public charity (not a private structure) when it uses for tax-exempt standing if it can show that it sensibly can be anticipated to be openly supported.

Fascination About Palau Chamber Of Commerce

If the internal revenue service classifies the not-for-profit as a public charity, it keeps this status for its first 5 years, no matter the public support it in fact receives throughout this time. Palau Chamber of Commerce. Starting with the nonprofit's sixth tax obligation year, it needs to show that it fulfills the general public support examination, which is based upon the assistance it gets during the existing year and previous 4 years.

If a nonprofit passes the examination, the internal revenue service will proceed to check its public charity condition after the initial 5 years by needing that a completed Arrange A be submitted annually. Palau Chamber of Commerce. Find out even more about your not-for-profit's tax condition with Nolo's book, Every Nonprofit's Tax obligation Guide.